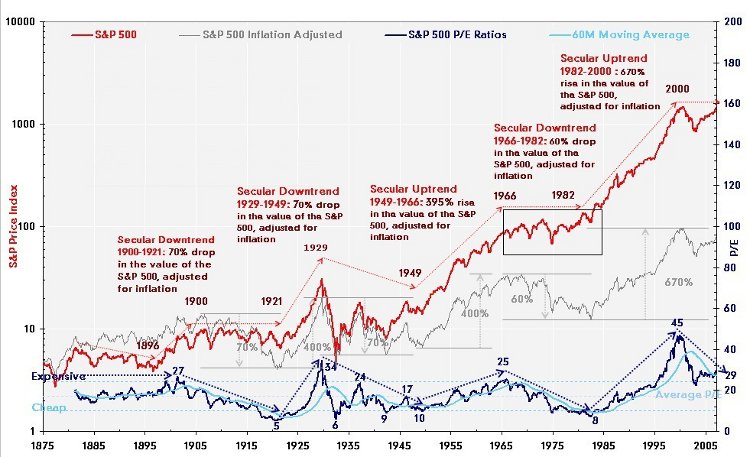

When it comes to determining the valuation of the overall stock market, the price-to-earnings ratio (PE ratio) of the S&P 500 is one of the oldest and most frequently used metrics. A S&P 500 PE ratio below 10 is generally considered cheap, while above 20 is considered expensive.

How to Calculate the S&P 500 PE Ratio

To calculate a single company’s PE ratio, you divide the company’s current share price by its last year’s earnings per share. However, to calculate the S&P 500 PE ratio, you would need to add up all the individual share prices and last year’s earnings per share for each of the 500 companies in the index, which can be a daunting task. Fortunately, there are websites such as https://www.multpl.com/s-p-500-pe-ratio that provide the current S&P 500 PE ratio.